Bitcoin halving and bull run 2024 , with the ETF approval

Bitcoin’s 2024 halving and the potential approval of BTC exchange-traded funds (ETF) are the two key events that could support the crypto market’s latest 2024 bull run. BTC supply-demand conditions will take advantage of BTC halving due in April 2024. Long-term Bitcoin (BTC) holders are collecting coins minimizing its supply. Institutional investor interest in BTC steadily rose in 2023 highlighted by record-high open interest in BITCOIN futures.

Bitcoin halving events occur every four years, minimizing the rate at which new BTCs are created by half of its total. The last Bitcoin halving took place in May 2020, and historically, some crypto holders and traders have associated these events with bullish trends in the crypto market and these are according to my point of view. However, someone must note that past events are not indicative of upcoming results, and this crypto market just can be unpredictable in the future.

The crypto market is influenced by various factors, including market sentiment, tech developments, regulatory shifting’s, and macroeconomic trends.2024 could be the year when Bitcoin leads another crypto bull market. BTC supply-demand conditions are ready to take advantage of the upcoming Bitcoin halving event due in April 2024.

We could see a scenario where BTC supply abruptly declines amid a surge of demand due to two crucial events – Bitcoin’s fourth halving event and the potential approval of Bitcoin exchange-traded funds.

Here, we will look at the possibility of a BTC’s next bull run from a supply-demand point of view.

Bitcoin Bull Run 2024: BTC’s Shrinking Supply

1. Bitcoin Halving 2024

Sometime in April 2024, Bitcoin is expected to undergo its fourth halving cycle, after which the number of Bitcoins minted with each block will reduce by up to 50% from 6.250 BTC to 3.125 BTC.

Bear in mind that newly minted coins first strike the coffers of BTC miners. Bitcoin mining is a capital-intensive operation that forces miners to sell a chunk of their Bitcoin-given income to cover their all operational expenses or transactions. Therefore, the market supply of BTC will not shrink at the rate expected immediately following the halving in 2024.

As the analyst Glassnode said:

the BTC Supply is VERY tight, with an all-time-high in CRYPT coins held by investors, and much higher rates of accumulation taking place there ”.

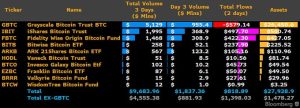

- Bitcoin ETF has been approved

Bitcoin exchange-traded funds ETFs will make it easier for retail investors to get exposure to Bitcoin. So far, institutional investors have shied away from crypto due to regulatory clarity, blackness, liquidity issues, and tracking capabilities. As BTC ETF has been approved, investment houses and hedge funds now will be gaining a safe, reliable, and regulated tool to access this Bitcoin market. Now the question is what is an ETF? ETF is an easy way to invest in and buy assets or a group of cryptos without having to directly buy the assets themselves. For example, the SPDR Gold Shares ETF allows every investor and trader to invest in gold without having to find a place to protect it.

- According to a report, the total crypto assets managed by US banks, and broker-dealers stood at $49.3 trillion. That is nearly 65 times the market cap of Bitcoin, which is currently at about $0.756 trillion.

Galaxy Digital estimated that the US could channel some more than $14 billion into Bitcoin ETFs in its Jan. 2024 launch, and BTC is adopted by 10% of total available digital assets.

Eric Balchunas, senior ETF analyst at Bloomberg, the tweet got authenticity since BTC ETF has been approved as predicted by him. The U.S. securities regulator on Wednesday approved the first U.S.-listed ETFs to track BTC, in a watershed for the world’s largest crypto. And this approval led the price of BTC to spike by more than $1,100.

Ver ennovelas Completas Gratis Online HD ✔️

Ver ennovelas Completas Gratis Online HD ✔️